About the Building

Learn about the 22-floor, limestone and sandstone headquarters of the Federal Reserve Bank of New York.

The 22-floor, limestone and sandstone headquarters of the Federal Reserve Bank of New York contrasts sharply with the neighboring steel and glass skyscrapers of the Manhattan’s downtown financial district.

Architecturally, the building is reminiscent of the Italian Renaissance period, featuring a robust palazzo design recalling the appearance of Florentine banking houses and elements of Florentine palazzos such as the Strozzi Palace and the Palazzo Vecchio.

The Bank’s 20th century American designers, like their 15th century Italian predecessors, sought a structural expression of strength, stability and security. These planners intended to inspire public confidence in the recently formed Federal Reserve System through the architecture.

Back to Top

Back to Top

On November 16, 1914, less than one year after Congress established the Federal Reserve System, the Federal Reserve Bank of New York opened for business in subleased offices at 62 Cedar Street in lower Manhattan. On that first business day, the staff of seven officers and 85 clerical employees—most borrowed from New York City banks and the Sub-Treasury—received $99,814,000 in deposits from 479 commercial banks.

Over the next four years, the Federal Reserve’s responsibilities and functions multiplied. It had to serve a growing number of member banks. The nationwide collection system was introduced in 1916, greatly increasing the volume of transactions. The entry of the United States into World War I the following year added to the responsibilities of the young Federal Reserve Bank: it helped finance U.S. military expenditures by selling and distributing government bonds and by becoming the fiscal agent of the federal government.

As the Bank’s need for space grew, new quarters were secured. By the end of 1918, the Federal Reserve Bank of New York was housed in six locations. It occupied several floors of the Equitable Building at 120 Broadway, the entire building at 50 Wall Street, 37 Liberty Street and miscellaneous facilities on Liberty and West 44th streets. The total square footage surpassed 203,000, more than a nine-fold increase since the end of 1914.

Despite the rapid acquisition of facilities during this time, the Bank’s space problems persisted. The main difficulty was that much of the space leased during this period of expansion was inappropriate for the Bank’s functions. The Fed’s large currency and check operations areas were in offices that were too small, and the ventilation and lighting was inadequate for these functions. On October 24, 1917, the Bank’s directors and officers issued a resolution calling for the construction of a new building suited to the special needs of the Bank. A real estate committee was appointed to oversee the acquisition of the property.

Back to Top

Back to Top

In 1918 and 1919, the Federal Reserve Bank purchased plot by plot, the site for the proposed building. A block in lower Manhattan bounded by Liberty, Nassau and William Streets and Maiden Lane was selected. The site, which was once part of a Dutch farm, contained an assortment of 19th century buildings. Because of the war, construction costs were increasing, so a decision was made to postpone starting work on the building until after the war had ended. In 1918 and 1919, the Bank purchased all but one of the buildings on the block for $4.8 million. The buildings (except the Montauk Building, fronting on William Street, which was acquired later) were demolished between May and September 1921.

Back to Top

Back to Top

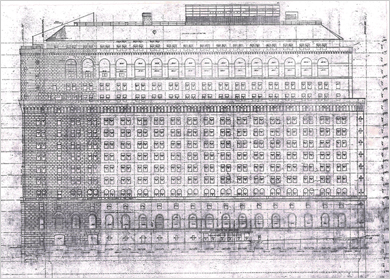

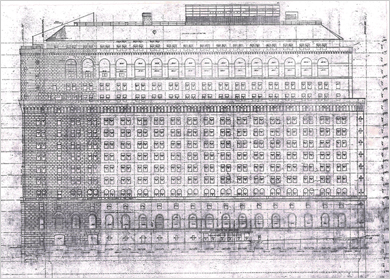

In early 1921, a building committee responsible for overseeing construction of the new facility was appointed by the board of directors of the Federal Reserve Bank. A consulting engineer, Alexander B. Trowbridge, was engaged to analyze the Bank’s office space needs and other requirements. The resulting 33 pages of specifications became the criteria for judging an architectural competition for the building contract. The designs of six competing firms were submitted anonymously and Trowbridge deemed York and Sawyer’s 800,000 square foot concept best suited to the Bank’s requirements.

Though architecturally out of sync with its time, Philip Sawyer’s design was commended for its simplicity, economy and restraint. His design popularized an architectural style for banks that was to be repeated throughout the country. York and Sawyer was awarded a prize of $10,000 and paid a fee of 6 percent of the cost of the new structure. The total costs were estimated at slightly less than $23 million.

Back to Top

Back to Top

Following the architectural competition, an ambitious and talented metal worker, Samuel Yellin, approached York and Sawyer with sketches of ornamental but functional ironwork to complement their conservative concept. The architects accepted Yellin’s bid. The Polish-American artisan’s first task was to double the manpower at his Philadelphia workshop to more than 200 people so that the new Bank’s wrought iron could be completed on time.

Although Yellin would accept many commissions for decorating churches such as the Cathedral of St. John the Divine and the Washington Cathedral; universities such as Harvard, Oberlin and Yale; private residences such as Edsel Ford’s and the Vanderbilt’s, none would call for the tonnage of iron required for the Federal Reserve Bank of New York.

Although Yellin was proficient in several styles, the designer employed an Italian technique consistent with the concept of the principal architect, Philip Sawyer. Many of Sawyer’s ideas were borrowed from Florentine palaces that had influenced him while studying in Italy. Specifically, the New York Fed’s monumental size suggests the Pitti Palazzo. The structure’s façade molding recalls the Vecchio Palazzo. Finally, the building’s stonework, arches and ironwork reflect the Strozzi Palazzo. It is notable that Yellin’s twin lanterns at the Bank’s public entrance are virtually identical to lanterns of the Strozzi.

Back to Top

Back to Top

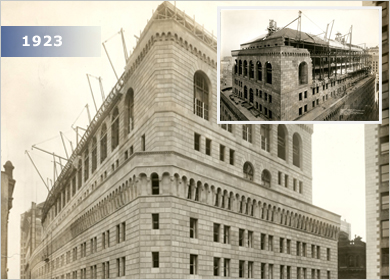

Beginning in 1921, the plot, except that area occupied by the Montauk Building, was excavated as much as 117 feet below the street to the bedrock of Manhattan Island, a task complicated by the weight of the buildings closely surrounding the construction site. Then the Bank’s triple-tiered vault system was lowered to the bedrock foundation—one of the few foundations considered adequate to support the weight of the vault, its nine-foot door and door frame (weighing 90 and 140-tons, respectively), and the gold inside, where almost a quarter of the world’s gold supply is safely stored today in 122 separate compartments.When it was completed and opened in September 1924, the lowest vault level was the deepest basement in Manhattan, descending 80 feet below street level and 50 feet below sea level.

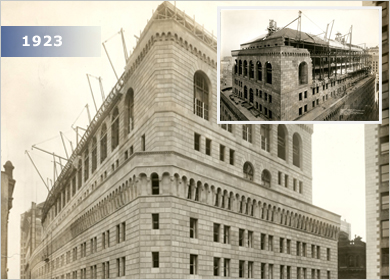

When the excavation was completed, the general contractors, Marc Eidlitz and Son, Inc., began constructing the building around the vaults. On May 31, 1922, the Bank’s cornerstone was laid by the New York Federal Reserve’s first Governor (President), Benjamin Strong. By the end of the year, the steel framework was erected. By mid 1923, the brick skeleton was completed and the stone façade was in place.

Though the period favored structures of uniform color, Sawyer elected to employ a multicolored stone façade, which combined sections of Indiana limestone with those of Ohio sandstone. Sawyer’s rationale was that such a polychromatic facing would lend character to the building’s Renaissance style and break up the monotony of its walls, which were basically void of ornamentation. The decision was also economical as odd lots of unmatched stone were purchased for the job at a substantial discount.

When it was completed in 1924, the New York Fed was the largest bank structure in the world. Filling almost the entire block bounded by Maiden Lane, Nassau, Liberty and William Streets. Its imposing façade draws from the solidity and forms of iconic Florentine palazzos. It is composed of rusticated limestone and sandstone ashlar with deeply inset bronze windows and doors, presenting a fortress-like image of strength and impenetrability. Original bank interiors were grand yet austere, not overly embellished.

Back to Top

Back to Top

In June 1924, the 2,600 officers and employees of the Federal Reserve Bank of New York began moving into the facility. Nonetheless, the single greatest obstacle to the building’s completion—acquisition of the Montauk Building on William Street—was still unresolved.

In 1918, the Bank had bid $400,000 to purchase the tall narrow building. The bid was refused. Shortly thereafter, a speculator acquired the building for $425,000 and offered it to the building committee for $1,250,000. The committee declined the offer and adopted a patient stance. York and Sawyer were instructed to build around the Montauk Building while retaining long-term plans for total project completion.

In September 1933, nine years after the first Federal Reserve Bank personnel moved into the new structure, the Montauk Building was bought for $326,250. In July 1934, erection of the new building’s eastern end was begun. The Bank was completed in July 1935 at a total cost of $21 million.

Back to Top

Back to Top

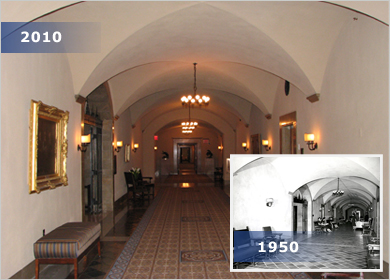

The building was designated a New York City Landmark on December 21, 1965, and was listed on the State and National Registry of Historic Places on May 6, 1980. Its beautiful rusticated ashlar facade with alternating blocks of limestone and sandstone is unique in New York City, and its monumentality and solidity combined with architectural detail convey an air of permanence and strength. Besides making note of its impressive external architectural design and ornamental features, the commission drew attention to the grand entrance hall, vaulted ceilings, stone walls and ornamental ironwork in the public spaces of the Bank.

Back to Top

Back to Top

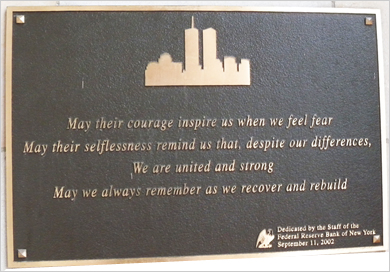

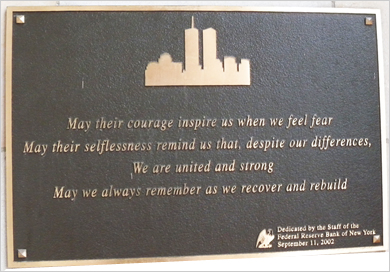

Given its close proximity to the World Trade Center, the New York Fed played an important role on September 11, 2001, and in the days, weeks and months that followed. In the immediate aftermath of the attack, the New York Fed ensured that essential trading and payments operations, and other critical banking and financial activities continued in the wake of the September 11, 2001, attacks on the World Trade Center.

Though trading in government securities did effectively stop on September 11 and 12, settlement continued.The basic dollar payments systems never closed. Although the money and foreign exchange markets were seriously disrupted, they also remained open.Within forty-eight hours of the attack on the World Trade Center, markets were once again serving their crucial function in the nation’s economy.

As for the Bank’s staff, Federal Reserve law enforcement officers, medical team and human resources staff were available to treat not only Federal Reserve employees but also pedestrians and emergency workers who needed medical attention. Even before the first tower collapsed, protection staff locked the vaults, secured the perimeters of the building and cleared a passageway through Maiden Lane so that emergency vehicles could more easily move from east to west toward the World Trade Center complex. At first, because the building was so close to the World Trade Center, staff were encouraged to remain in the Bank until there was some assurance that it was safe for them to leave the building and until it was clear that some public transportation had been restored, which occurred later that day.

While much of the staff worked their way home, a core group of employees stayed on at the Bank to carry out essential Bank functions and to maintain communication with other Federal Reserve System and central bank colleagues around the world. Late on September 12, employees were forced to leave the building because of concern that a nearby building at One Liberty Plaza might collapse, though staff were in place at contingency sites.

In the days and weeks after the attack, the Bank offered medical attention, shower facilities and free meals in the cafeteria daily to New York City police, fire department workers, the National Guard and other rescue workers in addition to Bank staff.The New York Fed also opened its doors to POPPA (Police Organization Providing Peer Assistance), a trauma counseling service for the New York City police, by offering this important group a place to meet. The New York Fed staff was grateful to be in a position to offer time and resources in support of the efforts of the September 11 rescue workers.

Back to Top

Back to Top

The New York Fed recently completed a necessary, multiyear effort to restore and modernize its main headquarters, the first major renovation since the 1930s, to make necessary upgrades to the building infrastructure, address safety concerns—including asbestos abatement, fire alarm and sprinkler enhancements and ventilation systems—and upgrade the building’s technology and electrical systems in order to ensure proper modern-day Bank business and operational efficiency.

- A comprehensive review and approval process, incorporating multiple layers of technical and financial approvals, competitive tenders, pre- and post-benchmarking best practices borrowed from comparable projects and third-party assessments, was employed throughout the program to ensure value optimization. The process included: multiple layers of technical and financial review, and external assessments, including three groups consisting of industry specialists—1) Peer Review Committee, (2) Restoration Committee, and (3) Board of Governor’s Architectural Review Committee—who reviewed the project during the design and construction phases;

- multiple rounds of approvals, by the Bank’s Investment Review Committee (IRC), chaired by the Bank’s first vice president, the Board of Directors and the Board of Governors;

- a competitive bidding process whereby the Bank conducted a thorough request for proposal (RFP) process to procure construction management and architectural/engineering services. Firms selected were chosen based on each firm’s combination of competitive pricing and extensive restoration experience;

- pre- and post-benchmarking best practices borrowed from similar projects.

- the Bank's Audit Group conducts regular, independent audits of the Bank's operations, including the modernization and restoration efforts since the program began in 1995.

The Federal Reserve recognizes the importance of transparency to its financial stability efforts and broader public mission, and continuously reviews opportunities where additional disclosure might be made.

The costs of the Bank’s Floor-by-Floor Modernization Program (started in 1995) are projected to be approximately $180 million over a 15-year plus period (approximately $10 million to $12 million per year).As a result of the program, the Bank’s office space is utilized more efficiently, thereby requiring less leased space in other buildings, and staff are able to work in a safe environment.

Since the New York Fed first occupied its main building at 33 Liberty Street in New York City’s Financial District (1924), the 22-floor Bank building (with four floors below and 18 above street level) and its staff have grown from an organization that began with less than 100 staff in one location to now more than 3,000 employees in four buildings.33 Liberty Street remains the main headquarters, with additional leased office space at 33 Maiden Lane and 3 World Financial Center, all in lower Manhattan. Additionally, the East Rutherford Operations Center in East Rutherford, New Jersey, houses the Bank’s cash processing and other operations.

By the early 1990s the modern-day New York Fed was straining the limits of its 1920s era office facilities. The Main Building lacked modern data infrastructure and security equipment.Cool air was supplied to offices by DC fans that dated back to the Thomas Edison era. It was time to address outstanding infrastructure and safety issues—like removing existing asbestos, and to modernize and restore this historic landmark.

The period of 2007 to 2010 was unprecedented for the amount of work and activity within the Bank as a result of the worst financial crisis since the Great Depression.As the New York Fed responded to staff expansion and work-space needs to accommodate approximately 600 staff hired during the crisis (to support increased demand in markets, bank supervision and other areas of operation), construction was finishing on other parts of the building.

To accommodate a projected 20 percent staff increase, only a 5 percent increase in leased office space was needed, due to space optimization efforts and efficiencies throughout the New York Fed’s existing office space.A redeployment of approximately 10,000 square feet of support space with a cost savings of roughly $400,000 per year on rental space (based on comparable downtown New York City rental rates) was also realized, and plans for redeployment are underway.

Back to Top

Back to Top

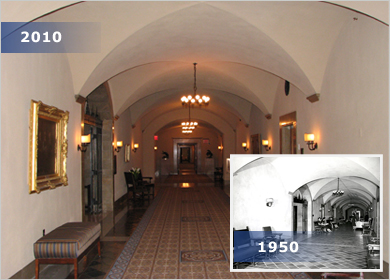

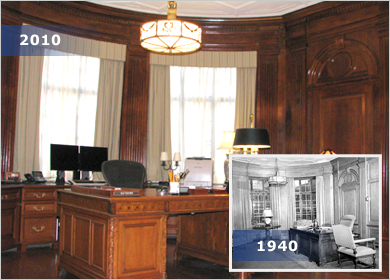

The most recent phase of the floor-by-floor modernization was the 10th and 11th floor restoration and support area consolidation. The renovations were aimed at making floors more functional, safe and flexible by upgrading the infrastructure and technology while preserving and respecting their historic character, and expending resources in a prudent and efficient manner. All modernization efforts were done while the building remained occupied and fully operational.

The floors have been reconfigured and upgraded to include new electrical, telecommunication, data, cable, fire alarm, sprinkler, elevator, air conditioning and ventilation systems—some of which were necessary improvements from the antiquated systems that dated from the 1930s. The phase also included upgrading conference rooms—including a multipurpose room with flexible configurations for meetings, Federal Reserve System conferences, seminars and crisis management—a new reception area to receive visitors, approximately 10,000 square feet of space recaptured for office space, and a new interior stairway to connect the 10th floor and 11th floor meeting facilities to improve traffic flow.

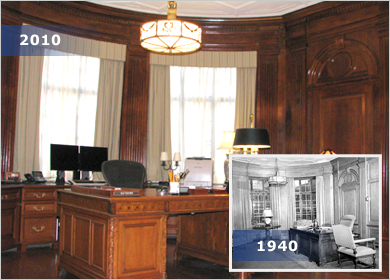

The latest modernization phase cost approximately $43.6 million ($35.2 million on construction, $6.0 million on design, and $2.4 million on furniture). The 10th and 11th floor restoration and support area consolidation consisted of five separate projects combined to take advantage of economies of scale and reduce cost. These projects included the restoration of historic features, the main hallway and Multipurpose Room on the 10th Floor; support space consolidation to improve layout efficiency; replacement and modernization of all antiquated systems, which were part of the broader modernization program (for example, electrical, telecommunication, fire alarm systems, etc.); the creation of conference space on the 10th and 11th floors and 10th floor office renovation, including the reuse of existing furniture, fixtures and finishes for the president and first vice president offices.

The modernization costs for the total project were $487 per square foot and for offices on the 10th floor were $353 per square foot—at the lower end of the range of the average cost of similar style offices in New York City ($303 to $423 per square foot, as of 2010 per New York City-based construction managers databases).The offices of the president and first vice president were materially lower, given the restoration, rather than replacement, of the floors, walls, ceilings and furniture. In addition, every care was taken to reuse or refurbish furniture to keep cost savings down (for example, furniture from the Bank's Buffalo Branch, which was closed in October of 2008, was repurposed in the Main building).

There were special challenges involved with the preservation and restoration of the floors’ architecture and finishes.

- Existing lighting fixtures and rare artwork original to the building were removed, refurbished, and reinstalled;

- In an effort to balance historic preservation with modernized and environmentally-friendly facilities, the Bank reused existing wood doors, paneling and trim work, which was removed, restored and then reinstalled.

The project was overseen by the Bank’s Restoration Committee and managed by the Bank’s Real Estate and General Services Function, with the assistance of outside architectural advisors.

The five guiding principles of the Bank’s Restoration Committee are to:

- Maintain the Bank's image of public integrity, strength and stability;

- Address the 10th and 11th floors with design that is respectful of the historic fabric of the Bank and brings fresh life to the environment;

- Support the Bank's strategic goals and the development of its desired corporate culture;

- Fulfill the contemporary functional and technological needs of the 10th and 11th floors; and

- Carry on the overall design intent of the Bank as described in the original Building Committee's records.

The project was approved by the Federal Reserve Board of Governors on Dec. 12, 2007, and was included in the New York Fed’s 2008 budget.

Project Summaries

Competitive Bid Process

Construction management and architectural/engineering services for the aforementioned projects enter a comprehensive approval, vetting and competitive bidding process.Included are additional details on the New York Fed’s approval process, request-for-proposal competitive bidding process and procurement policy.

Back to Top

Back to Top

The Building Owners and Managers Association (BOMA) International designated the New York Fed’s locations in New York City and East Rutherford, New Jersey as BOMA 360 Performance Buildings on June 27, 2011.

The BOMA 360 Performance designation recognizes commercial properties that are managed to the highest standards and demonstrate excellence in building operations. The program also evaluates and benchmarks a building’s performance against industry standards.

The New York Fed was recognized by BOMA for:

- Energy and Water Usage: Benchmarking the building’s energy and water consumption using the Environmental Protection Agency’s Portfolio Manager to identify efficiency improvements

- Renewable Energy: Conducting a renewable energy study to determine the effectiveness of installing solar or other onsite renewable energy sources.

- Operations and Procurement: Documenting green purchasing requirements and buying and using green cleaning supplies.

- Security: Conducting advanced evacuation drills and documenting security procedures and preparation programs.

- Prevention: Implementing an advanced preventative maintenance and tracking program to lower environmental and economic risks.

- Community Programs: Offering community involvement programs focused on mentoring, job skills and reading.

New York Fed's BOMA 360 Performance Program case study

Back to Top

Back to Top