| This new series, produced by the Research Group's Publications Function, focuses on the academic and public policy issues shaping our research. |

|

The Evolution of Banks and Financial Intermediation The Research and Statistics Group recently published the results of a broad investigation into the transformation of banks and financial intermediation over the last several decades. In a special issue of the Economic Policy Review and a seven-part companion series on the Liberty Street Economics blog, our economists look at the causes and consequences of the industry-changing shift in the way banks operate—from a deposit-funded, hold-to-maturity lending model to the more complex credit intermediation chain associated with securitization.

The two series also use supervisory and public regulatory data to document significant organizational changes in the size, scope, and complexity of large BHCs over the past thirty years. In one study, Dafna Avraham, Patricia Selvaggi, and James Vickery point to rapid growth in the number and types of nonbank subsidiaries held by BHCs, reflecting the wider scope of activities permitted with the passage of the Gramm-Leach-Bliley Act in 1999. Today, for example, two BHCs control more than 3,000 subsidiaries, and each of the six most organizationally complex BHCs manage more than 1,000 entities; by comparison, only one BHC controlled more than 500 subsidiaries in 1990. Another study, by Adam Copeland, describes BHCs’ shifting income mix over the last two decades. Copeland finds that small and medium-size organizations continue to earn the vast majority of revenue from interest income, but larger BHCs are aggressively building up new sources of fee-based income from securitization and other nontraditional financial services. Cetorelli, who coordinated the research and served as lead writer, recently discussed the significance of the two series, particularly their relevance to the design of regulation. “We’ve peeled off the layers of complexity of modern financial intermediation and shown that banks are still central players,” he said. “Of course, this finding doesn’t suggest that financial intermediation should remain bank centered. Risk migration has indeed become widespread. But banks can provide supervisors with a significant window into the meanders of the system, and help them recognize where risks may emerge going forward.” |

||||

|

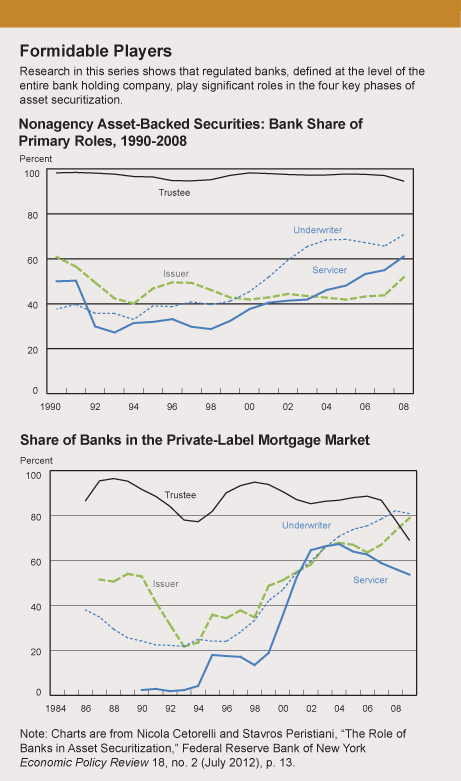

A key question driving the two series is the extent to which traditional banks and bank holding companies (BHCs) may have been eclipsed by the newer “shadow banks,” which appear to be playing an increasingly important role in a securitization-based market. To address the question, the authors of one study, Nicola Cetorelli and Stavros Peristiani, develop a quantitative “map” of the markets and players involved in the many steps of securitized lending. Their in-depth analysis of the universe of asset-backed securitization activity from 1978 to 2008 reveals the strong, even dominant, participation of regulated BHCs in the four roles critical to securitization: issuer, underwriter, trustee, and servicer. Significantly, this finding suggests that the current intermediation system may remain more open to regulatory scrutiny than is often thought.

A key question driving the two series is the extent to which traditional banks and bank holding companies (BHCs) may have been eclipsed by the newer “shadow banks,” which appear to be playing an increasingly important role in a securitization-based market. To address the question, the authors of one study, Nicola Cetorelli and Stavros Peristiani, develop a quantitative “map” of the markets and players involved in the many steps of securitized lending. Their in-depth analysis of the universe of asset-backed securitization activity from 1978 to 2008 reveals the strong, even dominant, participation of regulated BHCs in the four roles critical to securitization: issuer, underwriter, trustee, and servicer. Significantly, this finding suggests that the current intermediation system may remain more open to regulatory scrutiny than is often thought.