September 18, 2018: Maiden Lane LLC sold all remaining securities. Net proceeds from sales of the assets, as well as cash flow generated by ML LLC, provided a net gain of approximately $2.5 billion for the benefit of the U.S. public.

November 12, 2014: The legal existence of Maiden Lane II LLC and Maiden Lane III LLC was formally terminated. The small amount of cash held in reserve by each LLC was paid to the New York Fed and AIG, after payment of final trailing expenses, in accordance with their respective interests on November 20, 2014.

September 15, 2014: Remaining proceeds in Maiden Lane II LLC and Maiden Lane III LLC (apart from a small amount of cash held in reserve for trailing expenses) were paid to the New York Fed and AIG in accordance with their respective interest in each vehicle.

November 15, 2012: Net proceeds from additional sales of securities in Maiden Lane LLC enabled the full repayment of the subordinate loan made by JPMorgan Chase & Co. plus accrued interest. The New York Fed will receive 100 percent of future cash flows generated from the remaining ML LLC assets, in accordance with the ML LLC waterfall.

August 23, 2012: Maiden Lane III LLC sold all remaining securities. Subsequent to the repayment of ML III LLC’s liabilities to the New York Fed and AIG, net proceeds from sales of the securities, as well as cash flow the securities generated while held by ML III LLC, provided a net gain of approximately $6.6 billion for the benefit of the U.S. public.

July 16, 2012: Net proceeds from additional sales of securities in Maiden Lane III LLC enabled the full repayment of AIG’s equity contribution plus accrued interest and provided residual profits to the New York Fed. The New York Fed will continue to receive 67 percent of residual profits generated by future sales of ML III LLC assets.

June 14, 2012: Maiden Lane LLC and Maiden Lane III LLC repaid the loans made by the New York Fed, with interest. The successful repayment of the loans marks the retirement of the last remaining debts owed to the New York Fed from the crisis-era interventions with Bear Stearns and AIG.

February 28, 2012: Maiden Lane II LLC sold all remaining securities*. Net proceeds from sales of all the securities, as well as cash flow the securities generated while held by ML II LLC, enabled the full repayment of ML II LLC's liabilities to the New York Fed and AIG while also providing a net gain of approximately $2.8 billion for the benefit of the U.S. public.

Source: H.4.1 Factors Affecting Reserve Balances![]()

Note: Data reflects the outstanding FRBNY senior loan principal balance for each of the LLCs and does not include accrued interest. Chart was updated on a weekly basis through the repayment of the FRBNY senior loans.

| Maiden Lane Facilities as of 1/31/2019 ($ millions) | ||||||

|

Original FRBNY Senior Loan Balance |

Current Accrued Interest on Senior Loan | Cumulative Payments to FRBNY | Current Outstanding Senior Loan Balance with Accrued Interest | H.4.1 Portfolio Holdings Fair Value1 | Net Realized Gain / Income for FRBNY2 | |

| Maiden Lane LLC | $28,820 | - | $(31,305) | - | - | $2,486 |

| Maiden Lane II LLC | $19,494 | - | $(22,394) | - | - | $2,900 |

| Maiden Lane III LLC | $24,339 | - | $(30,989) | - | - | $6,650 |

|

Source: Federal Reserve Board H.4.1, Federal Reserve Bank of New York. 1 Portfolios remarked quarterly. Reflects 12/31/2017 prices applied to the portfolio as of the reporting date. 2 Net realized gain/income figure includes interest paid on the senior loan and any current residual balance paid to the New York Fed. |

||||||

|

The formation of the Maiden Lane LLCs in 2008 occurred during a time of severe economic distress in the United States. The sharp deterioration in the U.S. housing market in 2007, led to a loss of confidence in the value of mortgage-related products and in the financial institutions with exposures to these products. The ensuing funding pressures on a range of financial institutions and strained liquidity conditions across the financial system led the Federal Reserve to take a series of unprecedented policy actions to contain the broader risks the financial crisis posed to the economy. Among these actions, the Federal Reserve Board authorized the Federal Reserve Bank of New York (New York Fed) under Section 13(3) of the Federal Reserve Act Since 2008, the New York Fed has been focused on meeting the following objectives in the management of the Maiden Lane LLCs:

|

| Maiden Lane LLC (ML LLC) |

|

Purpose: ML LLC was created to facilitate the merger of JP Morgan Chase & Co. (JPMC) and Bear Stearns Companies, Inc. (Bear Stearns) by purchasing approximately $30 billion in assets from the mortgage desk at Bear Stearns. Terms: The New York Fed lent ML LLC approximately $28.82 billion. The loan has a 10-year term and accrues interest at the primary credit rate. JPMC lent ML LLC approximately $1.15 billion. The JPMC loan has a 10-year term and accrues interest at the primary credit rate plus 450 basis points. Investment Objective: Repay the New York Fed’s senior loan (including principal and interest), while refraining from disturbing general financial market conditions. Following a 2-year reinvestment period, monthly loan repayment commenced in July 2010.

On June 14, 2012, ML repaid the loan made by the New York Fed, with interest. |

| Maiden Lane II LLC (ML II LLC) |

|

Purpose: ML II LLC was created to alleviate capital and liquidity pressures on American International Group Inc. (AIG) stemming from its securities lending program by purchasing $20.5 billion in residential mortgage-backed securities (RMBS) from several of AIG’s U.S. insurance subsidiaries. Terms: The New York Fed lent ML II LLC approximately $19.5 billion. The loan has a 6-year term and accrues interest at 1-month LIBOR plus 100 basis points. The AIG insurance subsidiaries agreed to defer receipt of $1 billion of the purchase price. The fixed deferred purchase price accrues at 1-month LIBOR plus 300 basis points. Investment Objective: Repay the New York Fed’s senior loan (including principal and interest) while striving to maximize sales proceeds and refraining from disturbing general financial market conditions. Monthly loan repayment commenced in January 2009. On February 28, 2012, Maiden Lane II LLC sold all remaining securities*. Net proceeds from sales of all the securities, as well as cash flow the securities generated while held by ML II LLC, enabled the full repayment of its liabilities to the New York Fed and AIG while also providing a net gain of approximately $2.8 billion for the benefit of the U.S. public. |

| Maiden Lane III LLC (ML III LLC) |

|

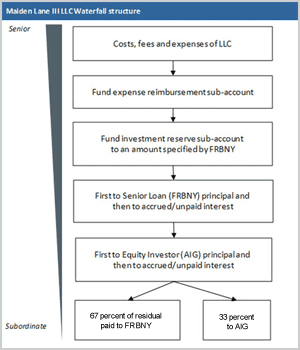

Purpose: ML III LLC was created to alleviate capital and liquidity pressures on American International Group, Inc. (AIG) stemming from credit default swap (CDS) contracts written by AIG Financial Products Corp. (AIGFP) by purchasing $29.3 billion in multi-sector collateralized debt obligations from certain AIGFP counterparties, enabling AIGFP to terminate the associated CDS. Terms: The New York Fed lent ML III LLC approximately $24.3 billion. The loan has a 6-year term and accrues at 1-month LIBOR plus 100 basis points. AIG contributed $5 billion of equity to ML III LLC. AIG’s equity interest accrues interest at 1-month LIBOR plus 300 basis points. Investment Objective:: Repay the New York Fed’s senior loan (including principal and interest), followed by AIG’s equity interest (including accumulated preferred distributions representing interest) for as long as the United States Treasury maintains an economic stake in AIG on behalf of the United States taxpayer, while also striving to maximize sale proceeds and refraining from disturbing general financial market conditions. On June 14, 2012, ML III LLC repaid the loan made by the New York Fed, with interest. On July 16, 2012, net proceeds from additional sales of securities in Maiden Lane III LLC enabled the full repayment of AIG’s equity contribution plus accrued interest and provided residual profits to the New York Fed. On August 23, 2012, ML III LLC sold all remaining securities. Subsequent to the repayment of ML III LLC’s liabilities to the New York Fed and AIG, net proceeds from sales of the securities, as well as cash flow the securities generated while held by ML III LLC, provided a net gain of approximately $6.6 billion for the benefit of the U.S. public. |

|

The New York Fed established the Investment Support Office, a staff of asset specialists and senior managers, to oversee and coordinate all matters related to the ML LLC, ML II LLC and ML III LLC assets. In consultation with New York Fed senior management and the Board of Governors of the Federal Reserve System, the Investment Support Office works with the investment manager, other service providers, auditors, internal financial risk managers, accountants and lawyers to ensure that the portfolios of the LLCs are managed appropriately and to maximize the likelihood that the senior loans from the New York Fed are repaid. As part of this work, the Investment Support Office carries out a range of responsibilities, including:

|

* As part of the close-out procedures for Maiden Lane II LLC, on August 22, 2012, the New York Fed sold eight residual securities that had been factored to zero and consequently dropped from the portfolio holdings report published by the New York Fed. There was no active notional balance associated with these positions as the securities were fully written down prior to the last ML II sale on February 28, 2012; thus, the subsequent sale of these zero-factor securities had no material impact on the net gain reported for the ML II portfolio.

|

1. Transaction Overview

2. Significant Transaction Terms 3. Management of Portfolio Assets 4. Vendors 5. Periodic Releases 6. Asset Sales |

In March 2008, Maiden Lane LLC (ML LLC) was formed to facilitate JPMorgan Chase & Co.’s (JPMC) merger with Bear Stearns Companies Inc. (Bear Stearns) and prevent the contagion affects of Bear Stearns’s disorderly collapse to the broader U.S. economy. ML LLC borrowed $28.82 billion from the Federal Reserve Bank of New York (New York Fed) in the form of a senior loan, which, together with funding from JPMC of approximately $1.15 billion in the form of a subordinate loan, was used to purchase a portfolio of mortgage-related securities, residential and commercial mortgage whole loans and associated hedges (derivatives) from Bear Stearns.

|

Note: Derivatives includes swap contracts, futures, and options on futures |

|

The ML LLC transaction closed on June 26, 2008 based on Bear Stearns’s fair value of its assets as of March 14, 20081. The portfolio of assets and hedges had a fair value on March 14, 2008 of approximately $30 billion. The JPMorgan Chase subordinated loan will be the first to absorb losses, if any, on the liquidation of the portfolio assets. |

All the assets purchased originated from the Mortgage Desk of Bear Stearns. Under the terms of the agreement with the New York Fed, the assets purchased by ML LLC from Bear Stearns had to meet certain eligibility requirements. The due diligence review of the assets for adherence to the eligibility criteria was conducted by the New York Fed’s advisors, which included its investment manager, BlackRock Financial Management Inc. and Ernst & Young. Regardless of the final closing date of the asset purchase, in order to be eligible for purchase by ML LLC, the Bear Stearns assets needed to meet the following eligibility criteria as of March 14, 2008.

Securities Criteria: The securities purchased by ML LLC had to be U.S. domiciled and issued and U.S. dollar-denominated. The securities had to be rated investment grade, which was defined as rated BBB- or higher. Mortgage Whole Loan Criteria: All commercial and residential mortgage whole loans (i.e. non-securitized) had to be performing, which was defined as current or delinquent by no more than 30 days.

ML LLC purchased a pro-rata share of the macro, non-credit and credit hedges associated with the Mortgage Desk of Bear Stearns. Macro and non-credit hedges were largely in the form of interest rate swaps, futures, options on futures, U.S. Treasuries and agency mortgage TBAs. Credit hedges associated with the Bear Stearns Mortgage Desk’s outstanding positions on March 14, 2008, in the form of single-name credit default swaps (CDS) and to a lesser extent CMBX positions, were also purchased on a pro-rata basis. The CDS contracts purchased by ML LLC referenced investment grade and non-investment grade underlying securities. On an aggregate net basis, the single-name CDS positions purchased by ML LLC resulted in ML LLC being the protection buyer on the CDS contracts (i.e. holding a net short credit position). |

|

|

|

|

|

The New York Fed retained BlackRock Financial Management Inc. (investment manager) to perform the day-to-day management of the assets held in the ML LLC portfolio. The investment manager's objective for ML LLC's portfolio is to repay the New York Fed's senior loan (including principal and interest), while refraining from investment actions that would disturb general financial market conditions. The sale of assets from ML LLC through 2012 enabled the full repayment of its liabilities to the New York Fed and JPMorgan Chase & Co. The New York Fed is entitled to receive all residual profits earned by ML LLC.

1. The investment manager must manage portfolio proceeds in accordance with the objective described above, subject to the maintenance of sufficient liquidity to meet expected payments and obligations. Following the 2-year accumulation period, funds invested in short-term investments are limited to: Treasury securities and agency debt obligations with remaining maturity of a year or less; U.S. 2a-7 Treasury/Agency money market funds; and reverse repurchase agreements collateralized by U.S. Treasury and agency securities. 2. For purposes of managing interest rate risk the investment manager may enter into or purchase:

3. Transactions that create new exposures to credit derivatives, equities, commodities, foreign currency-denominated assets or sub-investment grade assets are expressly prohibited. For the avoidance of doubt, the termination of a credit derivative that results in a net non-zero exposure to a reference obligation is not considered a transaction that creates a new exposure. 4. For purposes of meeting the investment objective discussed above or to meet contractual obligations to derivative counterparties, the investment manager may take the following actions3:

|

|

|

As a normal course of business, ML LLC sells assets from its portfolio in order to meet its mandated investment objective. Asset sales have been conducted since the LLC’s inception and in a manner which refrains from disrupting general financial market conditions. The asset sales information provided below is intended to enhance the transparency around ML LLC portfolio asset sales. The New York Fed is providing the following information on the progress of the sales on a regular basis, taking care to preserve the effectiveness of the asset sales process:

The New York Fed welcomes and encourages small, veteran-, minority- and women- owned businesses to bid either individually or through meaningful partnership with others, on assets in the ML LLC portfolio. As the New York Fed is interested in better understanding and monitoring the diversity of those entities purchasing its assets, prospective and/or successful bidders, either bidding alone or in partnership with another bidder, may be asked to disclose information about their small, veteran-, minority- and women- owned business status as well as that of their business partners. Please note, however, that the fact that a bidder is a small, veteran-, minority- and women- owned business does not in any way impact the selection of a winning bidder. Inquiries related to ML LLC asset sales can be made at MLinquiries@ny.frb.org.

* As part of the close-out procedures for Maiden Lane II LLC, on August 22, 2012, the New York Fed sold eight residual securities that had been factored to zero and consequently dropped from the portfolio holdings report published by the New York Fed. There was no active notional balance associated with these positions as the securities were fully written down prior to the last ML II sale on February 28, 2012; thus, the subsequent sale of these zero-factor securities had no material impact on the net gain reported for the ML II portfolio. |

|

1. Transaction Overview

2. Significant Transaction Terms 3. Management of Portfolio Assets 4. Vendors 5. Periodic Releases 6. Asset Sales

Charts

|

|||||||||||||||||||||||||||

|

1. Transaction Overview

2. Significant Transaction Terms 3. Management of Portfolio Assets 4. Vendors 5. Periodic Releases 6. Asset Sales

charts

|

|||||||||||||||||||||

|

Timeline

* As part of the close-out procedures for Maiden Lane II LLC, on August 22, 2012, the New York Fed sold eight residual securities that had been factored to zero and consequently dropped from the portfolio holdings report published by the New York Fed. There was no active notional balance associated with these positions as the securities were fully written down prior to the last ML II sale on February 28, 2012; thus, the subsequent sale of these zero-factor securities had no material impact on the net gain reported for the ML II portfolio. |